Do you have a business that’s ready to sell online? What do you need to know in order to set up online payment processing? We’re not gonna lie: there’s a lot to learn, but one of the most important steps is setting up an easy way for your customer to pay.

In Costa Rica, the use of credit and debit cards, bank transfers, and mobile SINPE are all very common, and payment through Apple Pay is now available as well, allowing users to pay using their cellular devices. But when it comes to online payments, things get complicated.

At El Colectivo 506, we’ve experienced this ourselves. Our membership system allows us to fund some of our work, but implementing that recurring payment system on our website has been confusing.

When members of our WhatsApp community Emprendedores 506 proposed this topic for our November column, we turned to a member of the group to help us delve deeper into it: Pedro Gutiérrez, computer engineer, CEO and co-founder of Avify, an omnichannel inventory management platform. It allows companies to connect their inventory with the channels they use to sell their product, but also connects those sales with the “behind the scenes,” including parcel delivery, distribution logistics, billing and, inevitably, payment gateways.

“We were one of the first in Costa Rica to work on this,” Pedro says, who before founding Avify in 2021 worked on code development at another company where he was also CEO and co-founder. “Since 2017, when we fully began working with brands, we have worked with the first platforms that existed. We have gone through a lot of processes.”

What is a payment gateway?

Pedro explains that entrepreneurs who want to start the online sales process often begin by creating their own websites, or by opening a page on other sites such as Meta platforms. It’s normal for this process to take time: you have to make sure it looks nice and is easy to use.

There are many sales options that pair with websites, such as Shopify, Wix, Prestashop, Magento, or even platforms like WordPress when accompanied by plugins like Woocommerce. These platforms help you build your sales windows so that your client can see your products, select them, and put them in their virtual shopping cart.

However, those sales windows cannot process payments.

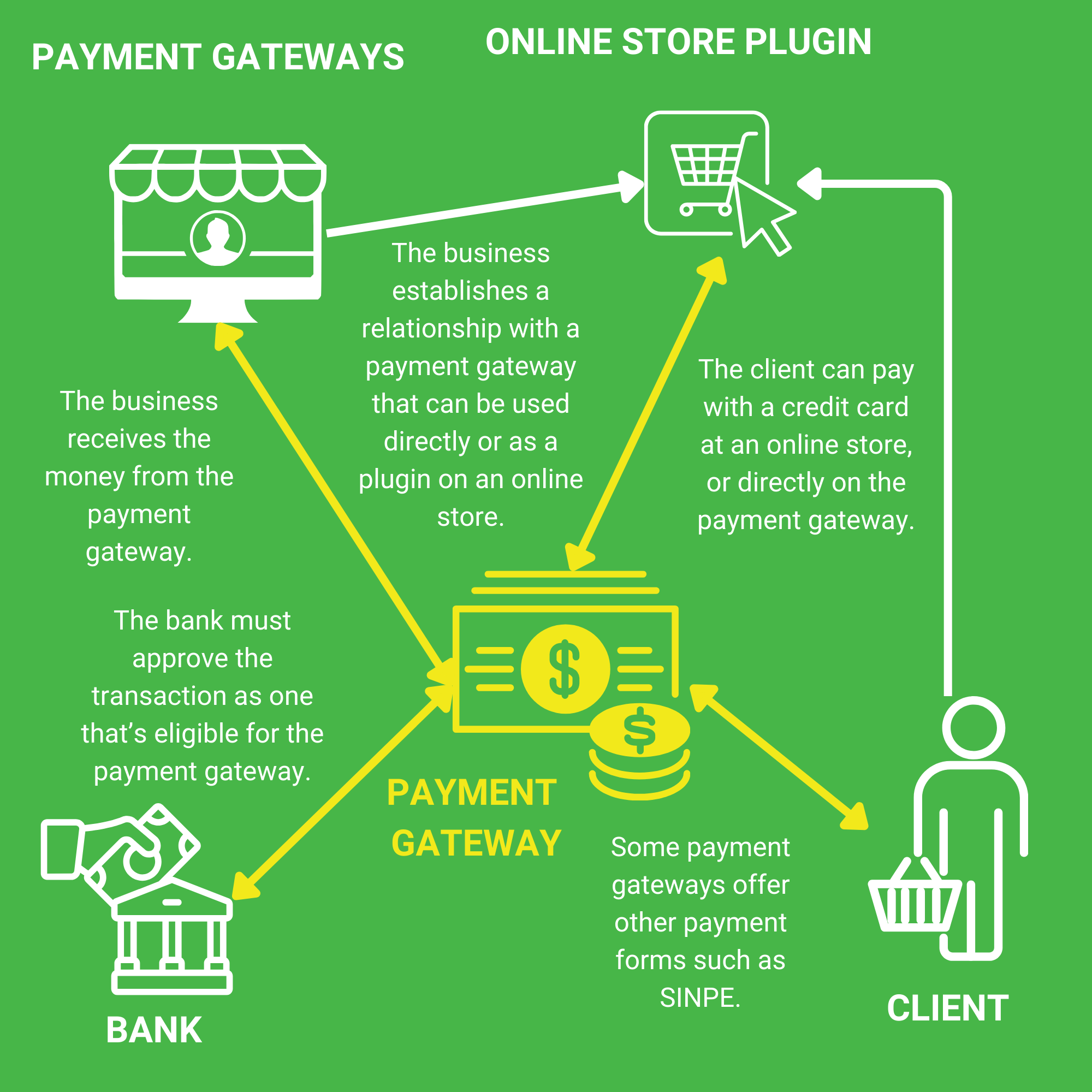

When the product is in the shopping cart, the payment gateway starts working, allowing you to process the payment—usually with credit or debit cards—so that eventually the money reaches your bank account in one of the Costa Rican banks.

The payment gateway is the bridge that allows you to connect your client with a bank to freeze the payment amount using a credit card or some other form of payment such as SINPE mobile. It then receives the money from the bank and gives it to you, the entrepreneur, so that you can receive the payment.

Pedro says that there are many payment gateways in the world, but not all of them work in Costa Rica. Why? Because Costa Rican banking legislation dissuades some companies from operating in Costa Rica.

If you select a payment gateway that does not operate in Costa Rica, you’ll have trouble accessing the money unless you have bank accounts in the countries where these platforms do operate.

Pedro, who works with practically all the payment gateway options that have operated in Costa Rica, tells us that there are approximately eight payment gateways already operating or starting operations in Costa Rica. The good news is that you’ve got choices.

What do I need in order to use a payment gateway?

Pedro says that in order to offer online payments with credit cards using payment gateways, your business must be approved by a banking entity in order to process these types of payments.

To do this, you need to present a series of documents that will be indicated by the payment gateway you’ve chosen. These usually consist of the single tax registration form (RUT) and, if your company is a legal entity, your shareholder registry. The online payment gateway presents this documentation to a bank, which will ultimately approve whether the business can offer these types of payments online through the selected gateway.

“These gateways are not banks,” explains Pedro. “They are systems that operate in conjunction with an acquiring bank, and since they are subject to SUGEF [Costa Rica’s General Superintendent of Financial Entities], they have permission to only process [collections]. Only the bank can approve the final transaction.

“If the bank detects an anomaly, they just reject it and don’t say why. [This anomaly can be] from the fact that your product isn’t eligible for ecommerce, such as pharmaceuticals, to the fact that you have a tax debt. It all depends on the bank.”

What does it take to set up your business with an online payment gateway?

Payment gateway services come at a cost. Each operator establishes its own rates, which normally consist of a basic rate for each transaction made, plus a percentage of the total transaction. There may also be basic recurring charges for the service, or an initial registration and installation charge.

“The game has been who charges the least. That is always relevant for the client,” explains Pedro. However, he says that entrepreneurs should also take into account what kind of customer service they’ll receive for the price.

“How can I actually talk to a human who will take care of my problem? It’s a money issue, and I want to get an answer as quickly as possible,” he says. “Unfortunately, not all of them have that service.”

Pedro also emphasizes that entrepreneurs who are considering online sales with payment gateways should know that Costa Rican legislation requires payment gateways to make withholdings related to the Value Added Tax (VAT) and the Sales Tax (IR). These legal withholdings are 5.31% of the 13% VAT, 1.77% which is reflected as part of the IR payment.

So for each transaction made, the total deductions that apply to the purchase are: the cost of the gateway service, the gateway commission for the transaction, the VAT on the gateway service, the partial VAT withholding, and the IR retention. For sales that include shipping services and charge them within the same transaction, all those deductions also apply.

“It is a significant amount,” says Pedro. “If I am including [the cost of] shipping in the transaction, the system deducts all of that [from the total amount], and that affects me.”

Examples of four payment gateways that operate in Costa Rica

Many banks in Costa Rica offer payment platform services, including Banco Nacional de Costa Rica, BAC Credomatic and Promérica. If you are a client of one of these banks, we suggest including researching the options that your bank offers.

The following three companies are payment gateways that operate in Costa Rica and are independent of banking entities, so they can work with more than one bank in the country.

OnvoPay:

Website: https://onvopay.com/

Payment methods: online store, recurring payments, single payment link.

Implementation cost or monthly payment: None.

Commission and transaction charges:

- With card: 3.9% + $0.25 per successful transaction

- Bank Transfer: 2.5% per successful transaction (minimum cost $0.5)

- SINPE MÓVIL: 1.5% per successful transaction

Earnings Settlement Frequency: The system makes a daily cut and the settlement can be processed at any time, but it has a minimum amount of $30 or ₡20,000.

Cost for liquidation of profits: $3.00 per transfer

More information here.

TiloPay:

Website: https://tilopay.com/

Payment methods: online store, recurring payments, single payment link.

Implementation cost or monthly payment: None.

Commission and transaction charges:

- With card: 4.25% commission, plus $0.35 per transaction

- SINPE MÓVIL: 2% commission, plus $0.35 per transaction

Earnings Settlement Frequency: does not specify on their website.

Cost of liquidation of profits: does not specify on their website.

More information here.

GreenPay:

Website: https://greenpay.me/

Payment methods: online store, recurring payments.

Implementation cost or monthly payment:

- between $15 and $30 + VAT monthly, includes a maximum number of transactions.

Commission and transaction charges:

- With card: 3.8% of the cost per transaction of the authorizing bank

Earnings Settlement Frequency: daily (T+1), weekly, biweekly or monthly.

Cost for liquidation of profits: $2.00 per transfer

More information here.

What other gateways might come to mind when researching payment gateways in Costa Rica?

One of the most common and easiest services to implement on a website as a payment gateway is Paypal. However, it is important to know that PayPal does not have a commercial relationship with any bank that operates in Costa Rica. Therefore, to bring that money into Costa Rica, you need to deposit it in a bank account in another country and then make an international transfer. There are third-party services that carry out that transaction for you, but they normally charge very high rates.

Pedro says that Payvalid and Be here are starting to work in Costa Rica, but they are still new platforms in the market.

A member of Emprendedores 506 sent us a specific question for Pedro: why doesn’t Stripe, a well-known international payment gateway, work in Costa Rica?

“They are a [U.S.] payment gateway,” Pedro responds, “and they do not have operations in Central America and Latin America, only in Mexico. They are not under the banking jurisdiction [of Costa Rica]. Due to VAT and income withholding issues it is not a location that interests them. At this time, they are interested in penetrating Mexico as a primary market.”

What should I ask myself before working with a payment gateway?

Pedro believes that the most important thing for businesses to consider before implementing online sales is whether their clientele needs online sales options, and whether they offer a product that can grow with audiences that buy online.

“65% of sales are compulsive,” Pedro explains. “So it’s about how I can make [the customer’s] life easier by paying me as quickly as possible, and that if they register, their data is already saved for future purchases.”

This report was created with the support of Banco Popular.

We thank Pedro Gutiérrez for participating in the interview and for being an active member of our Entrepreneurs 506 community. We have no commercial relationship with Avify, but we thank Pedro for sharing his time and expertise to clarify this issue that community members requested we study on their behalf. Avify wants to offer people who read this article a free month on their services by mentioning that they heard about the company through this article. You can contact Avify through their WhatsApp chat, which you can find on their website.